In the world of business and finance, the term IPO frequently pops up in headlines—especially when a fast-growing company makes its debut on a major stock exchange. But what exactly does IPO mean, why is it important, and how does it impact companies, investors, and the broader market? This article breaks down everything you need to know about Initial Public Offerings (IPOs).

What Does IPO Stand For?

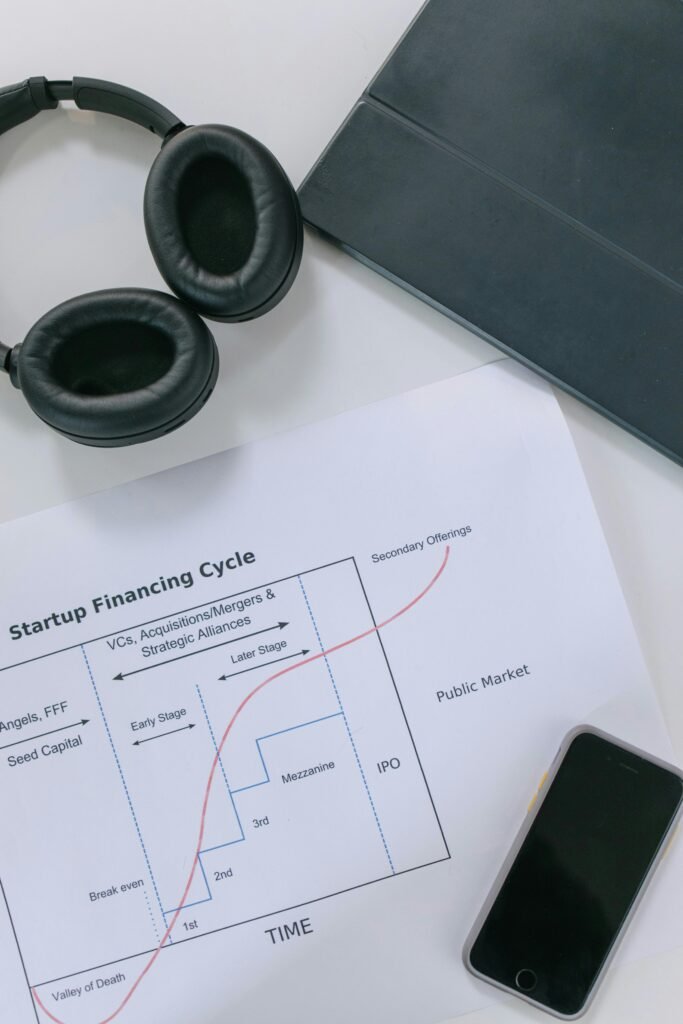

IPO stands for Initial Public Offering. It refers to the first time a private company offers its shares to the public and becomes listed on a stock exchange. Essentially, it marks the company’s transition from private ownership to public ownership.

Once a company is public, its shares can be bought and sold by individual and institutional investors in the open market, such as the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange, or Euronext.

Why Do Companies Go Public?

There are several reasons why a company might choose to go public:

1. Raise Capital

Going public allows companies to raise significant amounts of money by selling shares. This capital can be used for expansion, research and development, acquisitions, debt repayment, or other strategic investments.

2. Increase Visibility and Credibility

Public companies often gain greater media exposure and public trust. An IPO can boost the company’s reputation, attract customers and partners, and signal that it has reached a certain level of maturity and financial strength.

3. Provide Liquidity

An IPO gives early investors, founders, and employees the chance to cash out part of their holdings and realize profits. Before the IPO, shares are typically illiquid—after going public, they can be sold on the stock market.

4. Talent Attraction and Retention

Public companies often offer stock options or restricted stock units (RSUs) as part of employee compensation packages. This can help attract top talent and retain existing team members by giving them a direct stake in the company’s future success.

The IPO Process

The IPO process is complex and involves several key steps:

1. Choosing Investment Banks (Underwriters)

The company hires investment banks to manage the IPO. These banks help determine the company’s valuation, set the IPO price, buy the initial shares, and then sell them to investors.

2. Filing the Prospectus

The company prepares a prospectus or registration statement (e.g., an S-1 form in the U.S.) detailing its financials, operations, business risks, and the purpose of the IPO. This document is submitted to regulators such as the SEC (U.S. Securities and Exchange Commission).

3. Roadshow

Company executives present their business to potential investors, analysts, and fund managers in what is called a “roadshow.” This step is meant to generate interest and gauge demand for the offering.

4. Pricing the IPO

Based on market feedback and investor appetite, the underwriters and company set an offering price per share.

5. Going Public

On the IPO day, the company’s shares begin trading on the selected stock exchange. If demand is high, the stock price might “pop” above the IPO price.

Pros and Cons of Going Public

| Pros | Cons |

|---|---|

| Access to large amounts of capital | Expensive and time-consuming process |

| Increased public profile | Regulatory scrutiny and compliance |

| Liquidity for existing shareholders | Pressure to meet quarterly expectations |

| Ability to use stock for acquisitions | Dilution of ownership |

Famous IPOs and Their Impact

Some IPOs have gone down in history as turning points in business:

- Amazon (1997): Raised $54 million and went on to become a trillion-dollar company.

- Facebook (2012): Raised $16 billion in one of the largest tech IPOs ever.

- Alibaba (2014): Raised $25 billion—the largest IPO at the time.

These IPOs not only transformed the companies themselves but also shaped their respective industries and inspired new waves of entrepreneurship.

Alternatives to Traditional IPOs

While traditional IPOs are the most common route, companies now have several alternatives:

- Direct Listings: Shares are sold directly to the public without underwriters (e.g., Spotify).

- SPACs (Special Purpose Acquisition Companies): Companies go public by merging with a pre-existing listed shell company.

- Crowdfunding and Private Placements: Smaller companies can raise funds through digital platforms or private investors without going public.

Final Thoughts

An Initial Public Offering is a major milestone for any company. It opens up new financial opportunities, brings visibility, and allows everyday investors to become part-owners of promising businesses. However, it also comes with regulatory burdens and increased public scrutiny.

For investors, understanding the IPO process is essential to navigating the markets wisely. For companies, timing and preparation are key to a successful debut.

Need a professional website to grow your business across the EU?

👉 Rakuzan.eu provides digital business solutions tailored for entrepreneurs—website development, optimization, and more.

And if you’re launching online, make sure your hosting is fast and reliable.

👉 Use Hostinger to get started quickly and affordably.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or investment advice. Readers should consult with a licensed professional before making any financial or business decisions.