In the summer of 1944, as World War II was drawing to a close, a group of 730 delegates from 44 Allied nations gathered in the small resort town of Bretton Woods, New Hampshire, USA. Their mission was not military, but monetary: to reshape the global financial system and prevent the kind of economic chaos that had followed World War I and led to the Great Depression. The resulting agreement—known as the Bretton Woods System—laid the foundation for global finance and trade in the post-war world.

But what exactly was the Bretton Woods system? What decisions were made at the conference? And how did it transform the global economy for decades to come? This article explores the history, structure, and long-term significance of this landmark agreement that continues to influence global finance to this day.

The Historical Context: A World in Crisis

The early 20th century had been marked by economic instability. The interwar years saw hyperinflation in Germany, the crash of 1929, and a wave of protectionism that crippled global trade. Currency wars and competitive devaluations only worsened the economic depression.

World leaders realized that once the war ended, there would need to be a new, cooperative monetary order to promote global recovery, stability, and peace. It was against this backdrop that the United Nations Monetary and Financial Conference was convened in July 1944 at the Mount Washington Hotel in Bretton Woods.

Who Attended Bretton Woods?

Representatives from 44 Allied nations, including the United States, the United Kingdom, Canada, the Soviet Union, and many others, attended. The conference was led by two intellectual giants:

- John Maynard Keynes (UK): A renowned British economist who advocated for a global central bank.

- Harry Dexter White (USA): A senior U.S. Treasury official and architect of the American financial position.

Though Keynes was respected, the United States, as the dominant economic power, largely shaped the outcome.

The Core Objectives of Bretton Woods

The Bretton Woods system aimed to establish a stable international monetary framework to avoid past mistakes. The primary goals were:

- Exchange Rate Stability: Avoid competitive devaluations and restore trust in currency values.

- Open Markets: Encourage free trade by removing barriers to capital and goods.

- Monetary Cooperation: Create institutions to facilitate global economic coordination.

- Reconstruction and Development: Finance post-war rebuilding and development projects.

Key Decisions Made at Bretton Woods

1. Creation of the IMF (International Monetary Fund)

The IMF was established to oversee exchange rate policies and provide temporary financial assistance to countries facing balance-of-payments problems. Member countries contributed to a fund, which could be accessed during crises.

2. Establishment of the World Bank

Originally called the International Bank for Reconstruction and Development (IBRD), the World Bank was tasked with providing long-term loans to rebuild war-torn Europe and support infrastructure development in poorer countries.

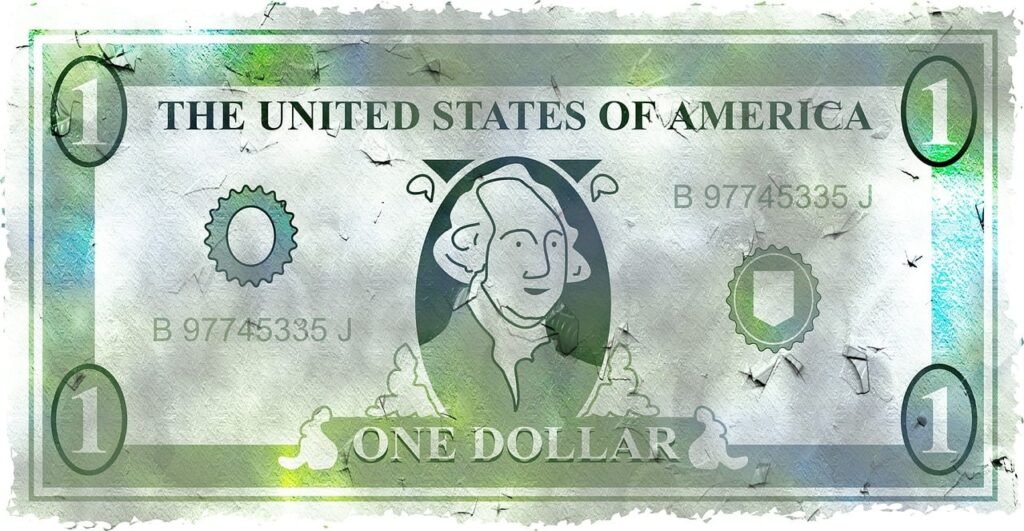

3. Fixed Exchange Rates Based on the US Dollar

Perhaps the most critical decision was the creation of a fixed exchange rate system:

- Each country fixed its currency to the U.S. dollar.

- The U.S. dollar was fixed to gold at $35 per ounce.

- This effectively made the dollar the global reserve currency, backed by gold.

Other currencies could fluctuate within a narrow band (±1%) and were adjusted only with IMF approval.

The Role of Gold and the US Dollar

Before Bretton Woods, most international trade was settled using gold or gold-backed currencies. After the 1930s, many nations abandoned gold due to economic pressures.

Under Bretton Woods, the U.S. promised to exchange dollars for gold, making it the anchor of the global monetary system. As a result, confidence in the dollar equaled confidence in gold, and countries began to hold dollars as reserves.

Successes of the Bretton Woods System

1. Economic Growth and Recovery

The system promoted economic recovery in Europe and Japan and supported the longest period of global growth in modern history, especially from the 1950s to early 1970s.

2. Currency Stability

Fixed exchange rates helped to stabilize currencies and reduce uncertainty in international trade.

3. Institutional Foundations

The IMF and World Bank remain critical institutions in the global economy, with roles far beyond what was imagined in 1944.

The Breakdown of the Bretton Woods System

Despite its early success, the Bretton Woods system began to falter in the 1960s.

1. Dollar Shortage Becomes a Dollar Glut

In the early years, countries lacked enough dollars to support global trade. But by the 1960s, U.S. spending on the Vietnam War and social programs flooded the world with dollars, undermining confidence in the dollar’s link to gold.

2. Gold Convertibility Under Strain

Foreign countries, especially France, began converting their dollar reserves into gold. The U.S. gold reserves started depleting.

3. Nixon Shuts the Gold Window

In August 1971, U.S. President Richard Nixon suspended the dollar’s convertibility into gold, effectively ending the Bretton Woods system. This move is known as the Nixon Shock.

By 1973, major currencies began floating freely, marking the transition to the modern floating exchange rate system.

The Legacy of Bretton Woods

Though the system lasted less than 30 years, its institutional and philosophical legacy endures.

Lasting Institutions

- IMF: Now focuses on financial surveillance, crisis lending, and technical assistance.

- World Bank: Plays a central role in global development and poverty reduction.

U.S. Dollar Hegemony

Despite the end of the gold standard, the U.S. dollar remains the dominant reserve currency, thanks to its liquidity, safety, and global trust.

Global Economic Cooperation

The Bretton Woods mindset—multilateral cooperation, shared rules, and institutional governance—continues to underpin modern global finance.

Criticisms of Bretton Woods

1. Dollar Dominance

The system heavily favored the U.S., giving it “exorbitant privilege” to run trade deficits without consequence.

2. Lack of Flexibility

Countries with economic imbalances struggled under fixed exchange rates and had limited tools to respond.

3. Developing Nations Excluded

Most developing countries had little say in the original agreement and saw few immediate benefits.

Bretton Woods in Today’s Context

In the wake of the 2008 global financial crisis and rising calls for monetary reform, some economists argue for a “Bretton Woods II” system. Ideas include:

- A new global reserve currency (possibly SDRs or a digital asset).

- Stronger regulation of cross-border capital flows.

- Greater voting rights for developing nations in IMF governance.

However, geopolitical tensions and fragmented national interests make such reforms challenging.

Conclusion: A Pivotal Turning Point

The Bretton Woods system was a bold experiment in international cooperation. For nearly three decades, it brought currency stability, economic growth, and a framework for rebuilding a shattered world. Its legacy continues through the IMF, the World Bank, and the role of the U.S. dollar.

Although no longer in operation, Bretton Woods remains a symbol of what is possible when nations work together to build a fairer, more predictable financial system. As the world faces new challenges—debt crises, digital currencies, geopolitical shifts—understanding Bretton Woods offers valuable lessons for shaping the future.

Want to build your own digital foundation?

Just like global economies rely on strong institutions, your business needs a stable digital presence. Get a sleek, secure, and mobile-optimized website from Rakuzan.eu — your trusted partner in web design and digital strategy.

Looking for reliable hosting? Choose Hostinger — known for blazing speed, 99.9% uptime, and unbeatable support.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or investment advice. Readers should consult with a licensed professional before making any financial or business decisions.